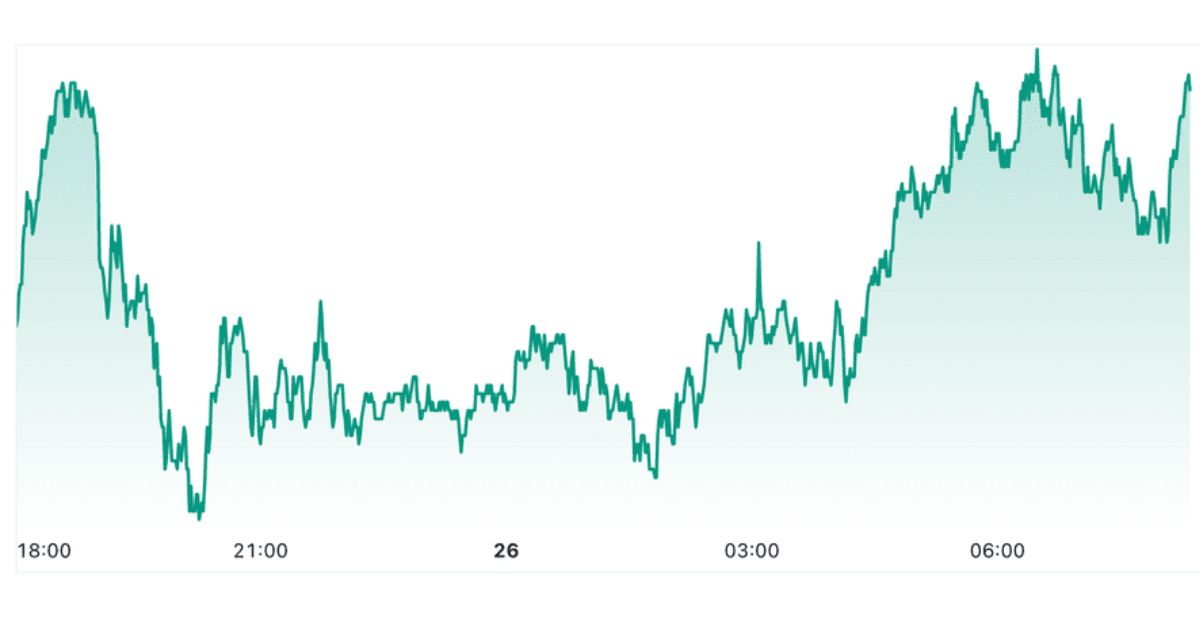

On February 26, 2024, stocks fell overall as the rally in chipmakers continued. The semiconductor industry showed further gains even as other sectors pulled back from recent highs. The broader S&P 500 slipped 0.8% daily, but optimism in chips underscored their strategic importance across many industries.

While chip stocks pushed ahead, concerns over rising interest rates and geo-political tensions led many investors to take profits in other growth areas. The pullback created opportunities for traders to shift capital into semiconductors riding strong demands.

The technology-focused Nasdaq index declined over 1% as many Big Tech names lost ground. However, chipmakers extended recent advances fueled by ongoing demand for everything from PCs to data centers. Micron gained 4% after optimistic remarks from its CEO, while Nvidia jumped 3% on expectations of further data center wins.

Key Takeaways

- Overall stocks fell on the day while the semiconductor industry saw further gains, with chipmakers continuing their recent rally.

- The Nasdaq index declined over 1% as large tech companies lost ground, while concern over rates and geopolitics prompted investors to take profits elsewhere.

- Optimistic comments from Micron’s CEO and expectations of more Nvidia data center wins fueled further chip advances.

- Broader S&P 500 dipped 0.8% daily but optimism in semiconductors underscored their critical importance across industries.

- The pullback created opportunities for traders to rotate capital from other growth areas into riding the ongoing strong demand driving the chipmakers surge.

Overview Of Markets News

On February 26th, 2024, overall stock markets declined as investors took profits, but semiconductor stocks continued rallying on strong demand. While the Nasdaq fell over 1% as large tech pulled back, chipmakers extended gains fueled by bullish predictions.

Don’t miss to read out this blog: Oakley Rae (Social Media Star) – Bio, Net Worth, Career, Age, Height, and More

Micron and Nvidia announcing optimism kept the sector surging, as the ongoing appetite for chips underscored their widespread role across industries. The pullback created buying opportunities for traders as rotations shifted capital to riding the sector’s gains.

Step By Step Guide To Markets News

- The overall stock markets declined on the day as investors took profits elsewhere, despite semiconductor stocks continuing their surge.

- Optimistic outlook from chip giants fueled further gains in the sector riding strong demand. Traders seized the chance to rotate capital into the thriving industry.

- The retreats created buying opportunities in chipmakers leading advancements, as their strategic importance underscored future potential for driving broader markets higher.

Equity Indexes Wrap: Tech Stocks Gain On Deluge Of Nvidia Partnerships; Alphabet Tumbles On Ai Worries

Nvidia’s impressive list of new partners in industries like transportation and technology boosted investor optimism for the ongoing revolution in chip demand. With Nvidia seemingly at the center of it all, its stock climbed along with others in the rapidly growing semiconductor space.

One high profile name suffered due to doubts creeping in around its ambitious AI projects, sending Alphabet shares down as questions arose over whether its research focus could consistently translate to real commercial progress.

Is The Curse Of The Dow Coming For Amazon?

As Amazon achieved the unprecedented feat of joining the exclusive Dow Jones Industrial Average, some market observers wondered if being inducted into the blue chip index could end up hurting the tech giant. With a historical tendency for Dow stocks to underperform after being added, some speculated

Amazon may succumb to the so-called curse of the Dow. Others noted the online retail behemoth’s continued strong growth prospects and argued its addition to the Dow was more a recognition of its status as one of the most influential corporations of the era.

Kroger Dips As Ftc Sues To Block Albertsons Merger

Kroger shares took a hit upon news that the FTC had filed an administrative complaint aimed at halting its proposed merger with Albertsons. While the two grocery heavyweights argued greater scale would help them compete against larger forces like Walmart.

Antitrust regulators clearly had their doubts. Investors grew skittish on the potential regulatory roadblocks ahead for a deal attempting to reshape the highly competitive supermarket landscape. Both chains now face an uphill battle convincing the FTC the combination would not unduly harm consumers.

What You Need To Know Ahead Of Salesforce’s Earnings Report Wednesday

As Salesforce prepared to unveil its quarterly results, investors scrutinized how well the cloud software pioneer navigated turbulent economic conditions that have squeezed spending in some areas. While macro headwinds lingered, expectations were that of Salesforce’s ubiquitous suite of business.

Comprehensive Guidance For This Blog: Who Is Kai Cenat’s Dad? Everything To Know About His Father

Applications helped clients engage customers and optimize operations through digital transformation. Any signs of weakening demand or reduced guidance would raise questions about resilience in Salesforce’s sprawling empire of tools guiding industries into the future of work.

Micron Stock Jumps On Production Of Ai-Powering Memory Chip

Micron provided a boost to its share price with news that it had commenced production of an innovative new memory chip optimized for AI and machine learning workloads. With global tech giants increasingly relying on data-crunching processors to power applications from self-driving cars to personalized analytics.

Micron aimed to stake a claim in a critical component supplying the necessary memory and storage. Investors bet on the chip’s potential to open new revenue streams if data centers and device makers embraced the company’s solution to the voracious memory demands of modern AI systems.

Domino’s Us Business Gains Help Boost Stock To 2-Year High

Domino’s stock climbed to its highest level in over two years as signs emerged of strengthening momentum in its core U.S. operations. While economic headwinds weighed on other restaurant chains, Domino’s strategy of prioritizing digital ordering and contactless delivery resonated well with consumers increasingly reliant on takeout.

International weakness was offset by Americans turning to familiar favorites, giving Domino’s a buffer against broader volatility and stoking optimism that bigger gains may lie ahead if pandemic-driven behaviors endure in the industry.

Alcoa Stock Slides After $2.2 Billion Takeover Offer For Alumina

Alcoa’s share price dropped after the aluminum giant moved to acquire a major Australian alumina refiner in a multibillion-dollar deal. While expanding supply chain control could support future profits, funding the large cash-and-stock transaction stirred some on Wall Street.

With economic challenges and high energy costs pressuring Alcoa’s own operations, some questioned adding more balance sheet burdens now. Nevertheless, others saw the strategic logic of gaining more direct access to a key bauxite input, if integration risks were adequately managed going forward.

Amazon Joins Dow Jones Industrial Average, Cementing Blue Chip Status

Amazon’s addition to the storied Dow Jones Industrial Average was a sign of its achievement of true corporate blue chip behemoth status. While the index change raised eyebrows given Amazon’s tech roots, its diversification into multiple industries proved it a force too dominant to ignore.

Also Read This Blog: Aiyifan: Redefining Daily Life With Advanced Intelligence

Brought both accolades and doubts, as some questioned if the e-commerce pioneer could continue its unprecedented rise within the Dow’s more conservative framework. However, Amazon’s reach offered a compelling case that it deserved its place among traditional industry titans.

Stocks Making The Biggest Moves Premarket

As market open approached, investors eyeing which key stocks showed premarket momentum or weakness aiming to gain early insight into sector sentiment. Some names saw activity linked to overnight news, but broader themes were also revealed.

A few travel-exposed players moved opposite healthcare stocks in a tell that growth concerns may trump virus risks on any given day. The pre-bell moves across the spectrum hinted at the market’s temperature and highlighted areas drawing focus at Tuesday’s opening bell.

Stock Futures Little Changed Ahead Of Pce Week

With all eyes on the imminent release of the Fed’s favored inflation gauge, stock index futures saw muted pre-dawn trade. After recent volatility, market participants adopted a cautiously neutral stance awaiting the key personal consumption expenditures report.

Any upside surprise could reignite worries over the central bank’s tightening path, while a softer reading may offer reassurance that price pressures are moderating. In the vacuum, few opted to place early directional bets, preferring to weigh the upcoming data before positioning for week’s weekend.

FAQ’s

Why Did Stocks Fall Yesterday?

A profit-take selloff came as chip gains stretched far. Investors rotated to recovered sectors showing relative value.

What Sectors Led The Declines?

Last week’s leaders’ technology and communications pulled back most. The semis still shined with further fab forecasts.

How Did Semiconductor Stocks Perform?

Chip successes continued powering forward despite broader drops. Nvidia’s next-gen launches lifted spirits industry-wide.

What Comes Next For The Markets?

All eyes watch inflation and interest rate moves ahead. Earnings will also guide flows within overstretched areas short-term.

Conclusion

As chipmakers Chevron and Nvidia climbed on earnings optimism, the broader market declined amid mixed signals on inflation and rates. While upside surprises could extend semiconductor gains in the near term, lingering macroeconomic uncertainty pointed to ongoing volatility.

As geopolitics and monetary policy risks loom, investors closed out the week with a cautious wait-and-see approach before the next round of key indicators that will provide insight into what lies ahead for global economic and market conditions.